Types of structure

Swing structure

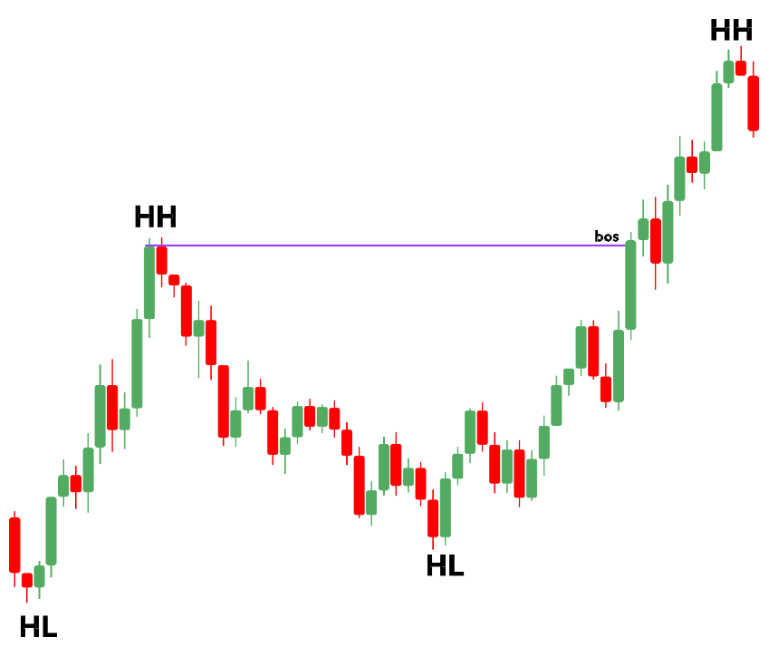

Swing structure - a standard structure whose significant elements (HH, HL, HL, LL) forms the general direction of the price

Substructure - a corrective movement within a standard (swing) structure. This structure forms (HL) for an uptrend, and (LH) for a downtrend.

Minor structure - swings (highs and lows) in the direction of the general price direction inside the swing structure. The movement from (HL) to (HH) on the uptrend, and the movement from (LH) to (LL) on the downtrend is a Minor structure

MBOS - minor bos - breakdown of minor structure by substructure

Failure Swing

SMS - shift in market structure. The case when the primary trend can not reach the new (HH) on an uptrend or the new (LL) on a downtrend. This tells us about the beginning of a corrective movement - substructure.

On a high timeframe it is a corrective movement, while on a lower timeframe it is the beginning of a new trend.

In the example above, the general direction of the asset is uptrend. Subsequently, the price failed to update the previous (HH), and started a local downtrend (substructure) to overlap the imbalance and test the support zone, after which the (HL) was formed, and after (HH), and the uptrend continued.

Also with an example of a downtrend swing. A rising substructure was formed, which formed (LH), after which a new (LL) was formed, and the downtrend continued.

Working with timeframes

Effective use of the structure is possible when analyzing the chart from higher timeframes to lower timeframes. To determine the general direction of the price, it is sufficient to analyze the five main timeframes. Higher timeframes are always in priority.

The main timeframes:

1 month, 1 week, 1 day, 4 hours, 1 hour 15m - 5m - to open the position

During the formation of (HL) after (HH) on 1W, most likely on the timeframes 1D, 4H, 1H the trend will change to a downtrend (substructure), and after the formation of (HL) when the price will test support area, the structure on these timeframes will synchronize again (minor structure)

Identification of structural elements and structure break

The first method - Сonservative

Structure identification: candlestick body

Structure break: candlestick body

The second method - Average

Most common

Structure identification: candlestick shadow

Structure break: candlestick body